This simple move ‘takes minutes’ to file a free federal tax extension, tax pro says — what to know

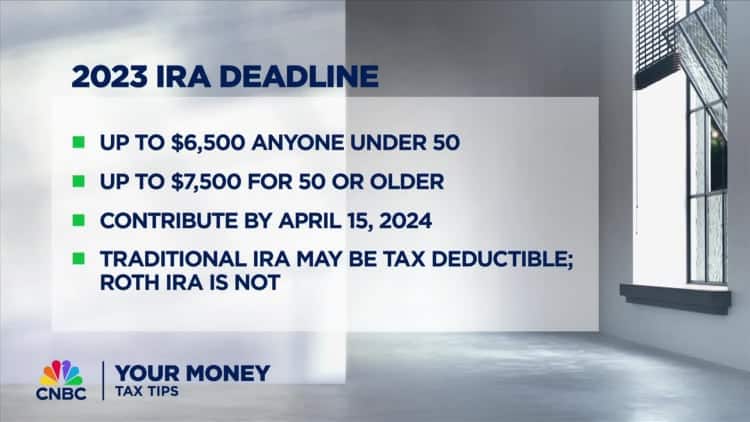

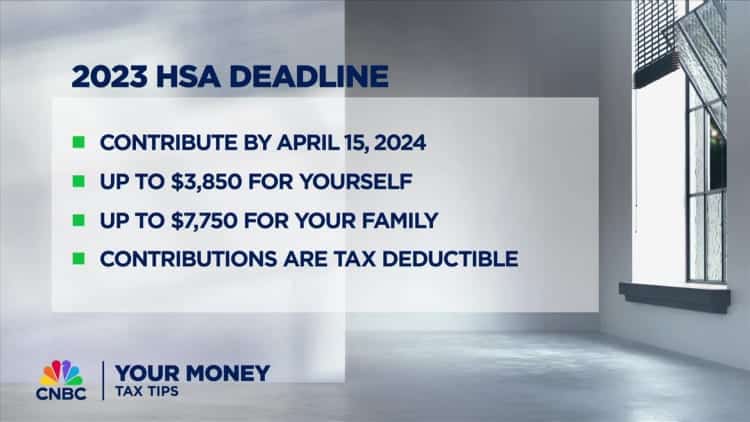

The federal tax deadline is April 15 for most taxpayers and you can still file for an extension, which pushes the due date to Oct. 15. You can file for an extension for free online and it “takes minutes,” one tax pro said. But you still must pay your estimated tax balance by the original […]